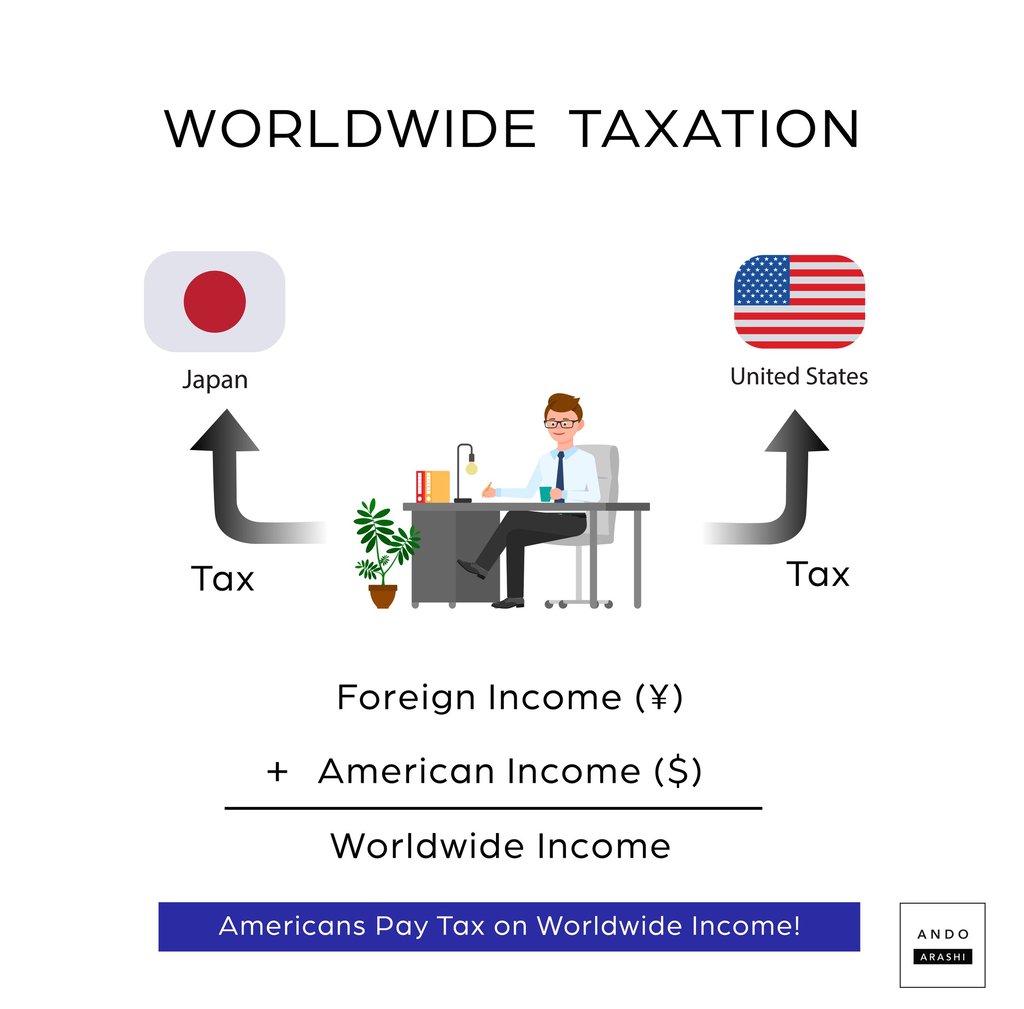

Worldwide Taxation for Americans

Americans pay tax on worldwide income

TAX

Andrew Haley

9/3/20242 min read

With the future of the USA uncertain, you might be tempted to just "F It" and move overseas. And truth be told, it's never been easier to work/live from anywhere.

But not many people know this...

As an American, your obligations to the IRS never end!

Let's dive in...

The USA is the ONLY G-20 nation to engage in "Citizen-Based Taxation"

Meaning the IRS taxes worldwide income, both received overseas and domestically

Even if you work for a completely foreign employer on foreign soil...

Even if you have no plans to return the USA...

At minimum...you still need to file a tax return each year

Also likely...you still owe IRS income tax each year

Many Americans abroad fall out of compliance and it's a compounding tax mess the longer they wait to fix

The basic concepts you need to know for each tax filing from abroad:

Report foreign earned income (converted back to US Dollars)

Report foreign passive income (ie foreign dividends...once again converted back to US Dollars)

Report Domestic Earned Income (ie Remote Work Position from a US Employer)

Report Domestic Passive Income (Domestic Dividents, Capital Gains)

Finally…

The sum of all domestic and foreign earned and passive income = "Worldwide Income"

And reported on the usual places on the Form 1040...no exotic forms required

But you ask...I've also been paying foreign taxes while living abroad

What's up with this unfair "double taxation"?

Well, the IRS offers relief via the Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Credit (FTC)

Foreign Earned Income Exclusion (FEIE)

Allowed:

W-2 type job with a foreign employer

Long-term overseas assignment with your US Employer

Self-employed person under certain conditions, even if all income is derived from the USA

Benefit: Exclude up to $120K of foreign income

Foreign Tax Credit (FTC)

Dollar-for-Dollar Reduction of US Tax Obligation via every dollar of Foreign Income Tax Paid

Credit is limited to your US tax obligation given your income/circumstance (Japan tax bill $15K, but your US tax bill is $12K...can only claim $12K FTC)

Lower income households (under $120K/yr income)

Waive right to use FEIE, use FTC instead

Allows you to continue to contribute to 401k/IRA without any complications (too complex to explain here; different post will explain in future)

Higher income households (over $120K/yr income)

Use both FEIE and FTC

Exclude first $120K of income with FEIE

Calculate amount of income over $120k and associated foreign income taxes paid just on that specific bucket of income = FTC amount

Many taxpayers abroad can eliminate the effect of double taxation via these two IRS provisions!

Living abroad can be extremely rewarding, but it comes with its own unique stressors

Do you have a Expat tax story from hell?

I'd like to hear it! How did you solve it?

Ando Arashi

878-223-0083

hello@ando-arashi.com

Ando Arashi® is a registered trademark of Ando Arashi LLC.

The firm is a registered investment adviser with the state of Pennsylvania, and notice-filed in Texas and may only transact business with residents of those states, or residents of other states where otherwise legally permitted subject to exemption or exclusion from registration requirements. Registration with the United States Securities and Exchange Commission or any state securities authority does not imply a certain level of skill or training.

© 2026 Ando Arashi LLC. All rights reserved.