Taxes on Social Security Income

Many people don't know: your social security benefits are taxable!

TAX

Andrew Haley

10/23/20243 min read

⁉️ Did You Know ⁉️

Many retirees are in for a surprise when they discover that their Social Security benefits are taxable!

For upper-middle-income folks with a 401k/IRA/pension, this means up to 85% of those benefits could be taxed as regular income

Let me teach you more...

You worked hard for +40 years during your career, contributed to Social Security (SS) every year, and are now ready to enjoy the fruits of your labor

Most people think they are all done with taxes associated with SS...and they would be wrong!

Most people reading this post are upper middle-income folks, with some level of outside retirement savings

For your demographic

(Annual Social Security Benefits) * 85%

= Amount added to your regular income for the year, subject to your normal marginal tax rates

That exact taxable inclusion ratio, whether its 85%, 50% or 0% is determine by a convoluted formula

It will be made more clear by a real-life example

Let's try to explain on a basic level

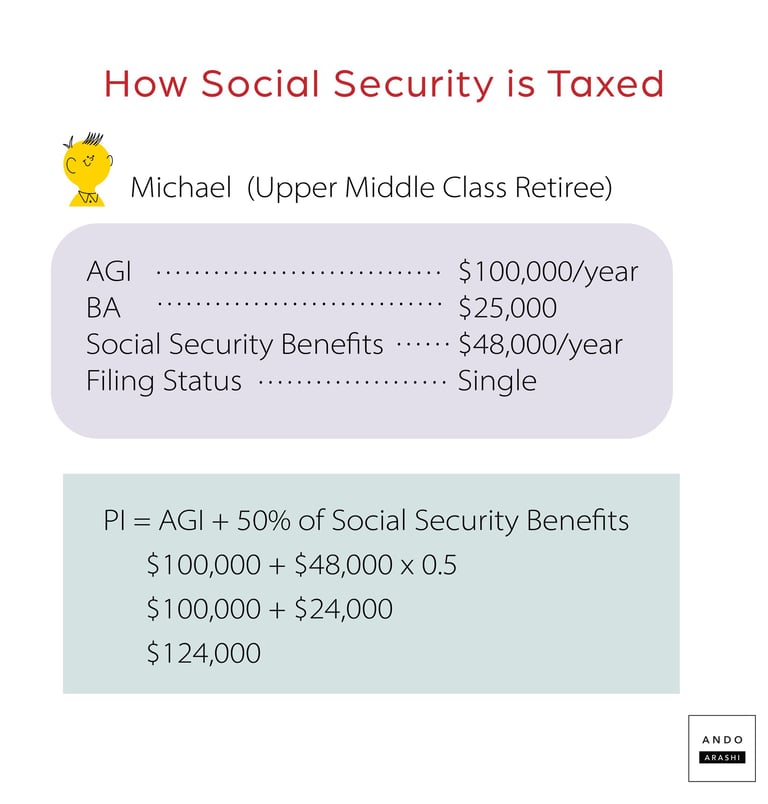

Meet Michael, an upper middle income retirew

He is a widower, and inherited his spouse's 401k and consistently saved in his own 401k for 30 years.

Bottom line, he is withdrawing roughly $100K/yr from his 401k before SS is even considered

His SS benefits are roughly $50K/yr

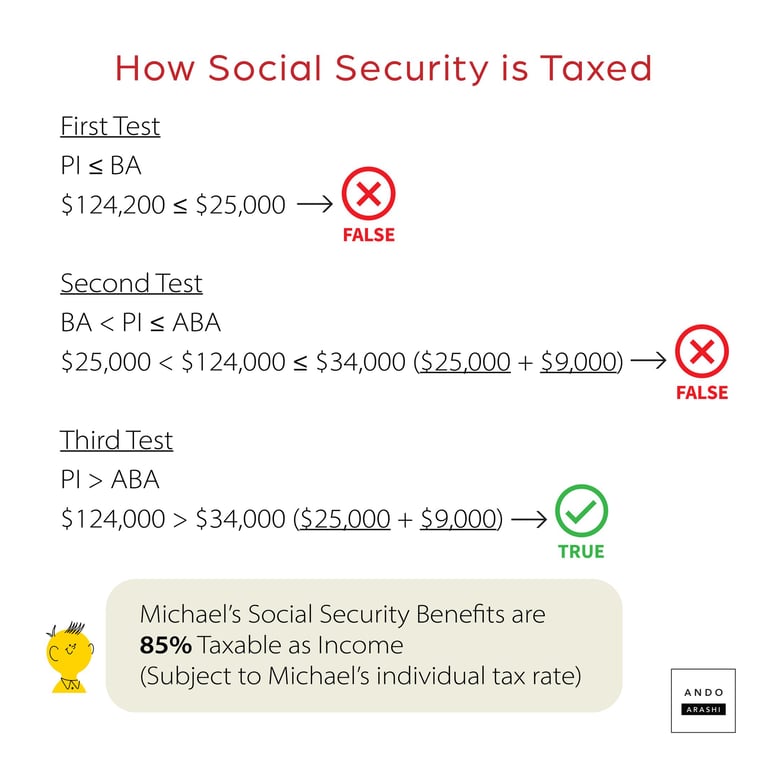

Step 1 for Michael:

Calculate Provisional Income (PI)

Adjusted Gross Income

+ (Social Security Benefits) * 50%

=PI

The picture explains the calculation clearly.

Michael PI = $124K

Step 2 for Michael:

Calculate Base Amount (BA)

This is a fixed number set by IRS

BA for Single People = $25K

BA for Married People = $32K

BA for Michael = $25K

Step 3 for Michael:

Calculate Adjusted Base Amount (ABA)

This is a 2nd fixed number set by IRS

ABA for Single People = $25K + $9K = $34K

ABA for Married People = $32K + $12K = $44K

ABA for Michael = $34K

Now with those basic numbers in mind, you run a series of logic tests to see which statement is true

Test 1: PI<BA

(If True; Stop...Your SS is 0% Taxable)

Test 2: BA<PI<ABA

(If True; Stop...Your SS is 50% Taxable)

Test 3:

PI>ABA

(If True...Your SS is 85% Taxable)

Now you didn't sign up for a math test by reading this post, so let's use Michael's numbers to make it crystal clear

As you see in the picture, Michael easily fails the first two tests, leaving only the 3rd test to be true

His SS benefits are 85% taxable

If you think he was not a good example (too wealthy)

Since that BA/ABA number is fixed by IRS (and not increasing with inflation)

With just modest 401k withdrawals plus modest social security income

Its super easy to have an PI above $34K and fail Tests 1+2 --> 85% Taxable

It makes you wonder...perhaps the complexity in the formula is on purpose, to hide how the US Govt is still taxing you to the max even in your golden years

For people reading this, I would just assume 85% until told otherwise by your financial advisor

If you DIY your finances, this is a great example of how a financial advisor can help model your retirement/SS income and help you lower your lifetime tax obligations

And where the advisors fee would pail in comparison to the taxes saved over 40 years

But you do you!

What do think about paying income tax on your SS benefits?

Fair/Unfair/Indifferent?

And should the formula be this convoluted or should it be so simple my 4th grader could figure it out?

I'd love to hear from you!

Ando Arashi

878-223-0083

hello@ando-arashi.com

Ando Arashi® is a registered trademark of Ando Arashi LLC.

The firm is a registered investment adviser with the state of Pennsylvania, and notice-filed in Texas and may only transact business with residents of those states, or residents of other states where otherwise legally permitted subject to exemption or exclusion from registration requirements. Registration with the United States Securities and Exchange Commission or any state securities authority does not imply a certain level of skill or training.

© 2026 Ando Arashi LLC. All rights reserved.